Bank of England base rate

What we are doing about the rising. The Bank of England base rate is currently 225.

Bank Of England Interest Rate Predictions 1 25 By End Of 2022 Says Capital Economics

Please enter a search term.

. It could rise to 075 in 2022 bringing it back to pre pandemic levels. The Bank of England BoE raised again its key interest rate by 50 basis points bps in the September meeting in an effort to cool soaring inflation. The Base Rate is the interest rate set by the Bank of England and is also known as the official Bank Rate.

LONDON The Bank of England voted to raise its base rate to 225 from 175 on Thursday lower than the 075 percentage point increase that had been expected by many. Interest rates set by the Bank of England are unlikely to rise above 5 as markets previously expected a senior official has suggested saying the hit to the economy from such a. The Bank of England BoE has increased interest rates by 50 basis points BPS taking the rate to a new 14-year high of 225.

The current base rate is 225. He added that its too early for the central bank to declare victory on holding expectations about future price increases to its 2 target. The bank rate was raised in November 2021 to 025.

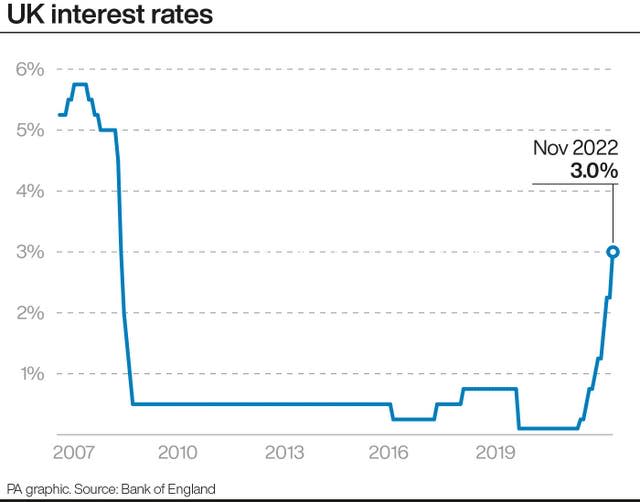

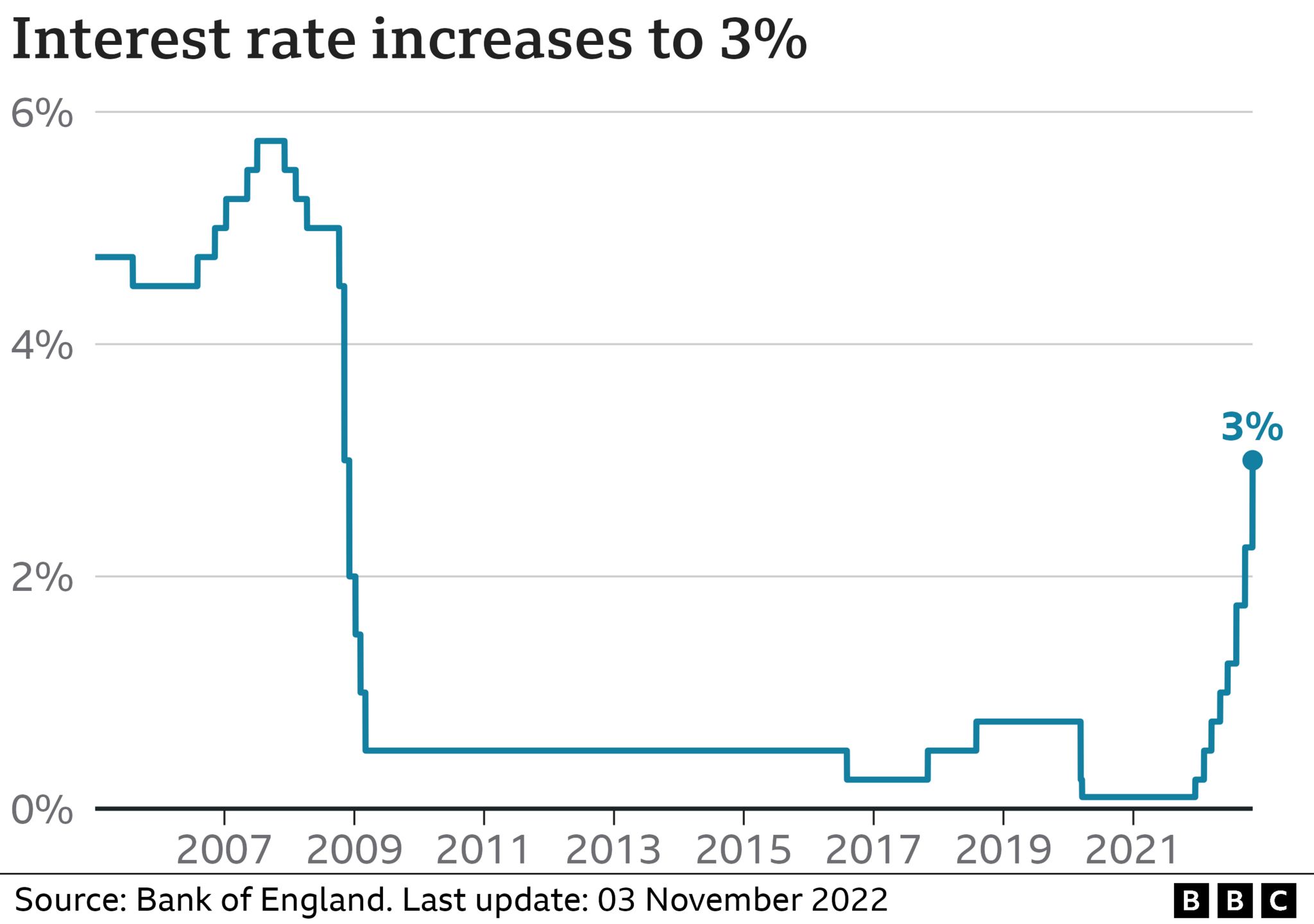

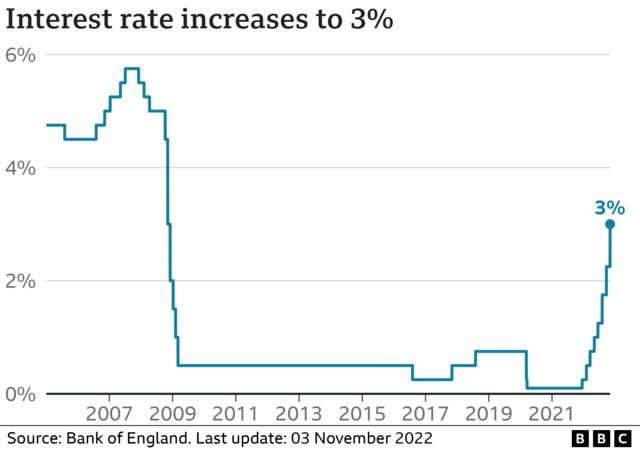

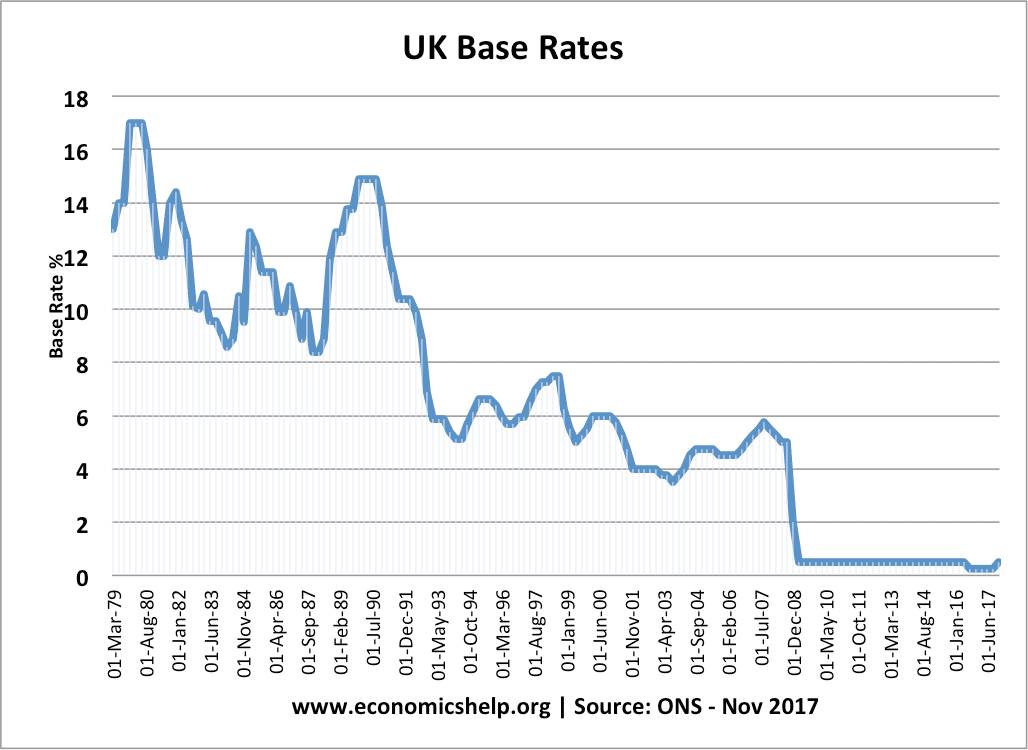

The base rate was previously reduced to 01 on. 47 rows The base rate is the Bank of Englands official borrowing rate. However the rise is not as stark as.

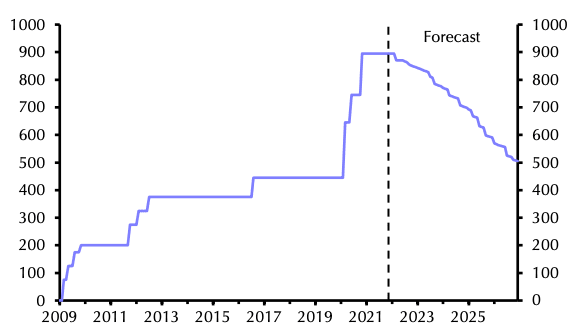

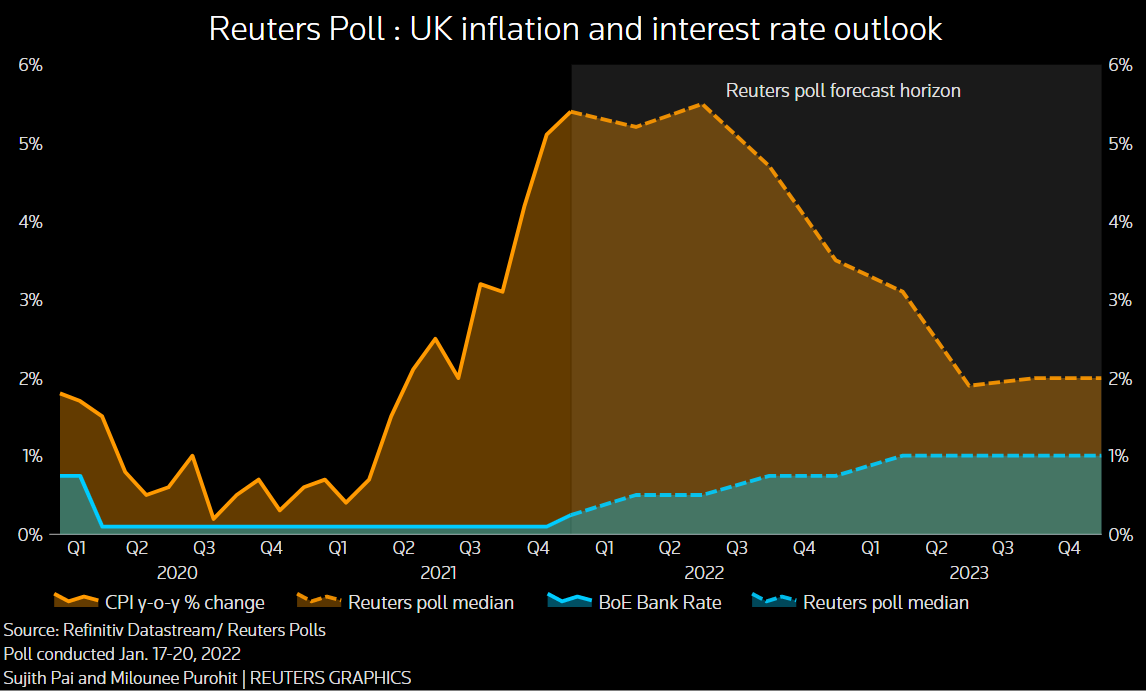

Bank Rate was previously seen topping out at 300 but that has now moved to 425 to be reached early next year and the highest forecast was for it to reach 575. Knowledge regarding bank rate and base rate is important for both borrowers and lenders in order to understand how these rates are affected by various economic conditions. The base rate was increased from 175 to 225 on 22 September 2022.

Continue reading to find out more about how this could affect you. The central bank repeated last months hike of half a percentage point taking rates to 225 from 175. Promoting the good of the people of the United Kingdom by maintaining monetary and financial stability.

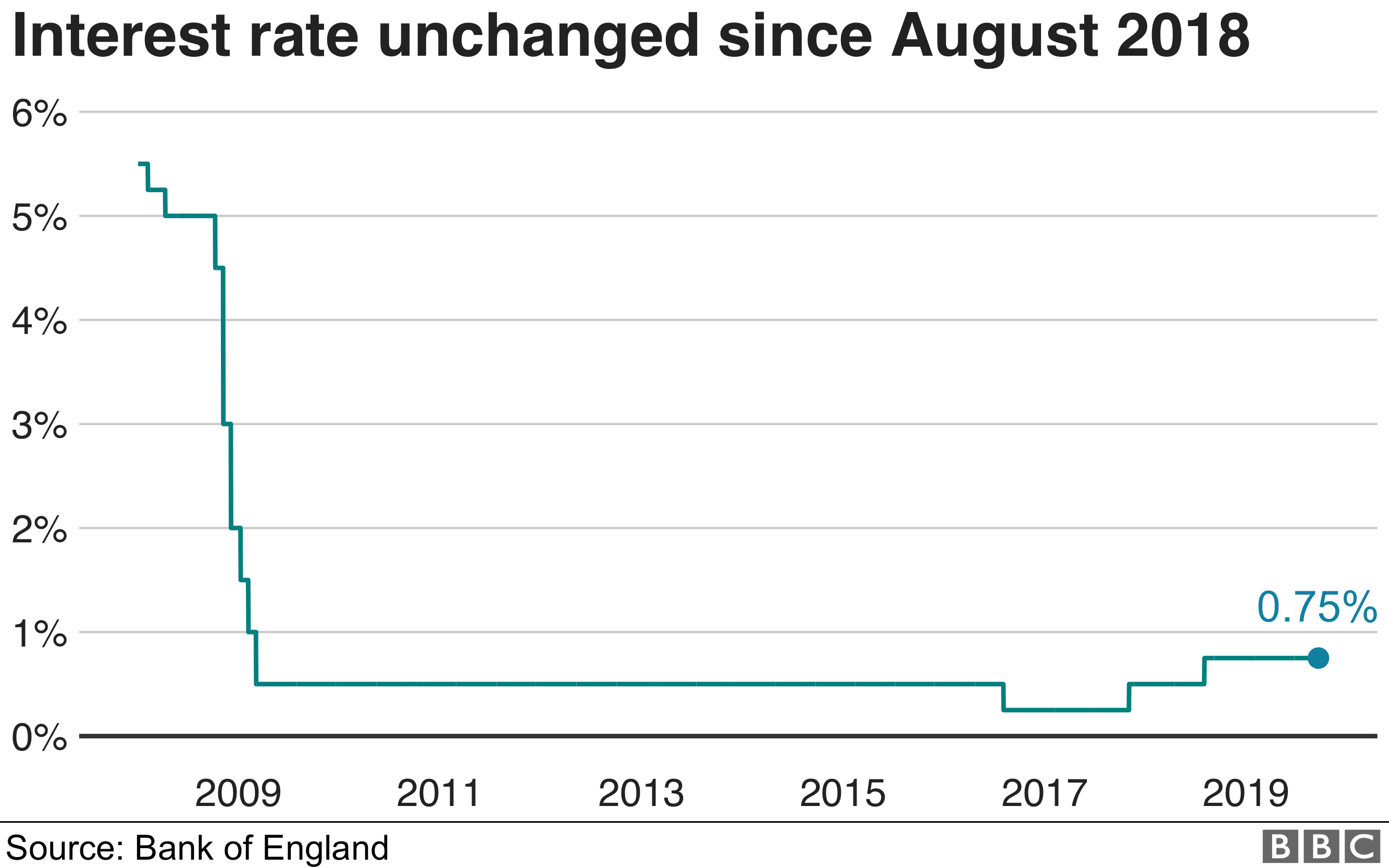

2017 to 2019. The Bank of England base rate is currently. More increases were expected but Brexit has reduced the chance of this happening.

In a development that will heap renewed pressure on mortgage holders the Banks key base rate is expected to reach 4 by May 2023 according to the path implied by financial. It was the seventh hike. It is currently 05.

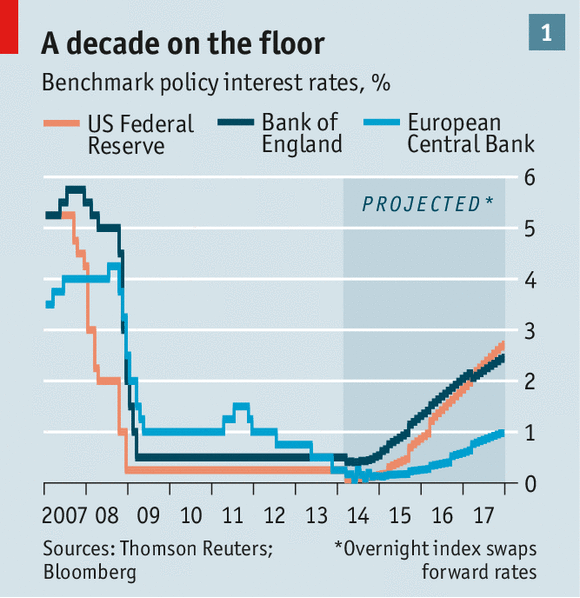

The MPC decides to increase the base rate to 05 and 075 soon thereafter. Henry Curr the Economics editor at Economist reports the Bank of England might increase the base rate to 58 in 2023 as inflation rises. While thats higher than it has been since the 2008 financial crisis its still considered on the low side historically keeping mortgage interest rates.

In August inflation in the UK. It said it expected inflation to peak next month at 11 lower than it.

Bank Of England Makes Biggest Rate Rise Since 1995 Fox Business

Inflation And Interest Rates Up Up And Away

Bank Of England Interest Rates How High Will They Go

Bank Of England Is Right To Take A Softly Softly Approach On Rates The Washington Post

How The Bank Of England Set Interest Rates Economics Help

Bank Of England Raises Uk Interest Rates And Warns Of 10 Inflation

Bank Of England To Raise Rates Again In February As Inflation Surges Reuters

Bank Of England Raises Rates But Avoids Bolder Hike Like Fed Macon Telegraph

Bank Of England Poised To Hike Interest Rates To 1 25 In Battle Against Inflation The Independent

Boe Follows Fed Lead With Biggest Rate Hike In Years Barron S

Uk Interest Rate Hike Is 1st In A Top Economy Amid Pandemic Wcyb

United Kingdom Interest Rate Uk Economy Forecast Outlook

Bank Of England Forecasts Low Interest Rates For Longer Bbc News